Ethereum is currently trading near $2,050 as of February 9, 2026, following a recent bounce from a steep sell-off. While short-term technical support near $2,000–$2,200 is being tested, the longer-term outlook remains divided: some scenarios anticipate a recovery toward $3,000+, while others warn of deeper losses if key levels break. Below is a clear, human-centered breakdown of ETH’s current value and what may lie ahead.

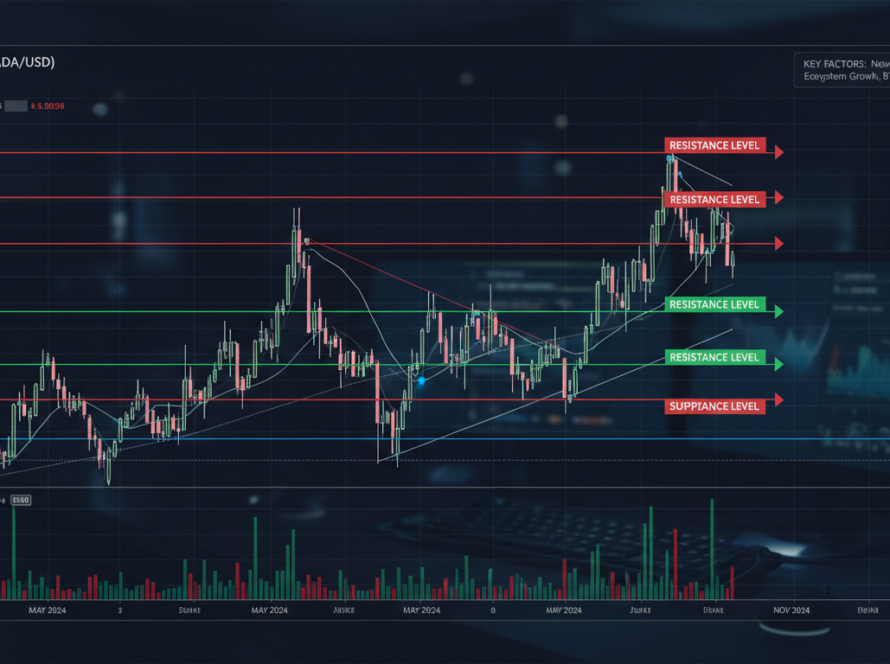

Current Price Snapshot and Technical Support

Ethereum fell sharply but then rebounded to around $2,049, marking an 11% recovery after dipping below $2,000 in recent trading.

This movement has Ethereum flirting with a critical support zone between $2,000 and $2,200, a level that bears watching. If breached decisively, ETH could face another leg down toward prior lows.

Others note even deeper pressures. In more extreme scenarios, ETH could revisit lows near $1,700–$1,800 depending on market direction.

Forecasts: Conservative, Moderate, and Bullish Scenarios

Conservative to Moderate Projections

- CoinCodex sees ETH around $2,376, with a potential rally to roughly $2,685 within days—suggesting modest rebound expectations.

- DigitalCoinPrice places February’s average in the low $2,000s, rising steadily through mid-year (e.g., up to about $2,055 by February 10, and possibly $2,400+ by mid-February).

- CoinMarketCap highlights a huge range—from mid-four-figure (e.g., $4,000) to five-figure extremes—depending on institutional and tokenization dynamics.

- InvestingHaven estimates a 2026 range spanning $1,669 to $6,500, with a central, moderate forecast between $3,000 and $5,000 under stable conditions.

Bullish and High-End Predictions

- Changelly anticipates an average near $4,700 in 2026; DigitalCoinPrice suggests a lofty climb toward $11,000 by year-end.

- Big-name analysts: Tom Lee sees ETH as Wall Street’s “operating system,” tipping it to $7,000–$9,000 early 2026 and perhaps up to $20,000. Standard Chartered projects $7,500 by end of 2026, rising to $12,000 in 2027.

- VanEck and Ark Invest echo optimism—with VanEck’s base-case pointing to $4,000–$8,000 and Ark eyeing $8,000+ mid-decade under deep adoption.

Alarm-Bell or Bearish Views

- Technical signals indicate that breaking below $2,690 could expose ETH to deeper losses toward $2,120. Resistance resides near $3,000–$3,340, above which stronger momentum could return.

- Regression and machine learning models warn of possible “panic” scenarios dipping ETH as low as $1,500–$1,800 if sentiment collapses.

- Analyst Ben Cowen doubts ETH will retest its high, citing a fragile Bitcoin backdrop and the risk of bull traps.

Real-World Drivers Behind the Trends

- Liquidations exceeding $2 billion, macro uncertainty, and a flight from risk assets have intensified selling pressure on ETH.

- Political and internal tensions in Ethereum’s foundation—torn between purist visionaries and institutional pragmatists—have fueled investor frustration amid sluggish price action.

Human Insight: A Closer Look

“The best long-term buys occur below the 200‑Week SMA—a level many consider historically significant. Yet the true floor could be closer to $1,800.”

Models like these blend quantitative rigor with narrative urgency, offering paths through a volatile market. Success hinges on bridging technical analysis with real-world context—like ETF flows, network upgrades, or macro shifts that can swing sentiment.

Summary of Forecast Ranges

| Scenario | Price Range | Key Drivers |

|————————–|————————–|————————————————————-|

| Conservative/Moderate | $2,000 – $5,000 | Support hold, institutional adoption, modest recovery |

| Bullish | $6,000 – $12,000+ | ETFs, supply shocks, tokenization, institutional inflows |

| Bearish | $1,500 – $2,000 | Support break, macro headwinds, negative sentiment cycles |

Conclusion

Ethereum trades near $2,050 today, hovering at a critical juncture. Unless support solidifies, further downside is probable. Yet, if institutional interest and structural catalysts re-emerge, ETH could rebound strongly, potentially reclaiming ground well above $3,000. Navigating this high-variance environment requires flexible strategies, readiness for rapid shifts, and a clear sense of evolving risk-reward dynamics.

FAQs

What are the main support levels to watch for ETH right now?

Key support lies between $2,000 and $2,200, with a more critical point near $2,120. A decisive breakdown could expose deeper downside.

Are short-term forecasts reliable?

Short-term models show ETH potentially reaching $2,600–$2,700 in days, but broader volatility and sentiment swings make such projections tentative.

Is a jump toward $10,000 realistic?

Yes, but only under accelerated adoption, major ETF inflows, and tokenization-led supply constraints. These represent bullish, high-variance scenarios.

Could Ethereum lose significant ground?

Absolutely—negative macro factors or technical breakdowns might drive it back toward $1,500–$1,800 in a bear scenario.

Why do predictions vary so much?

Forecasts diverge due to differing assumptions on adoption pace, institutional framing, network upgrades, regulatory clarity, and macroeconomic pressure.